Budget 2026

Nirmala Sitharaman presents: IT Sector Gets Tax Boost but With New Compliance Rules — What You Must Know (Budget 2026)

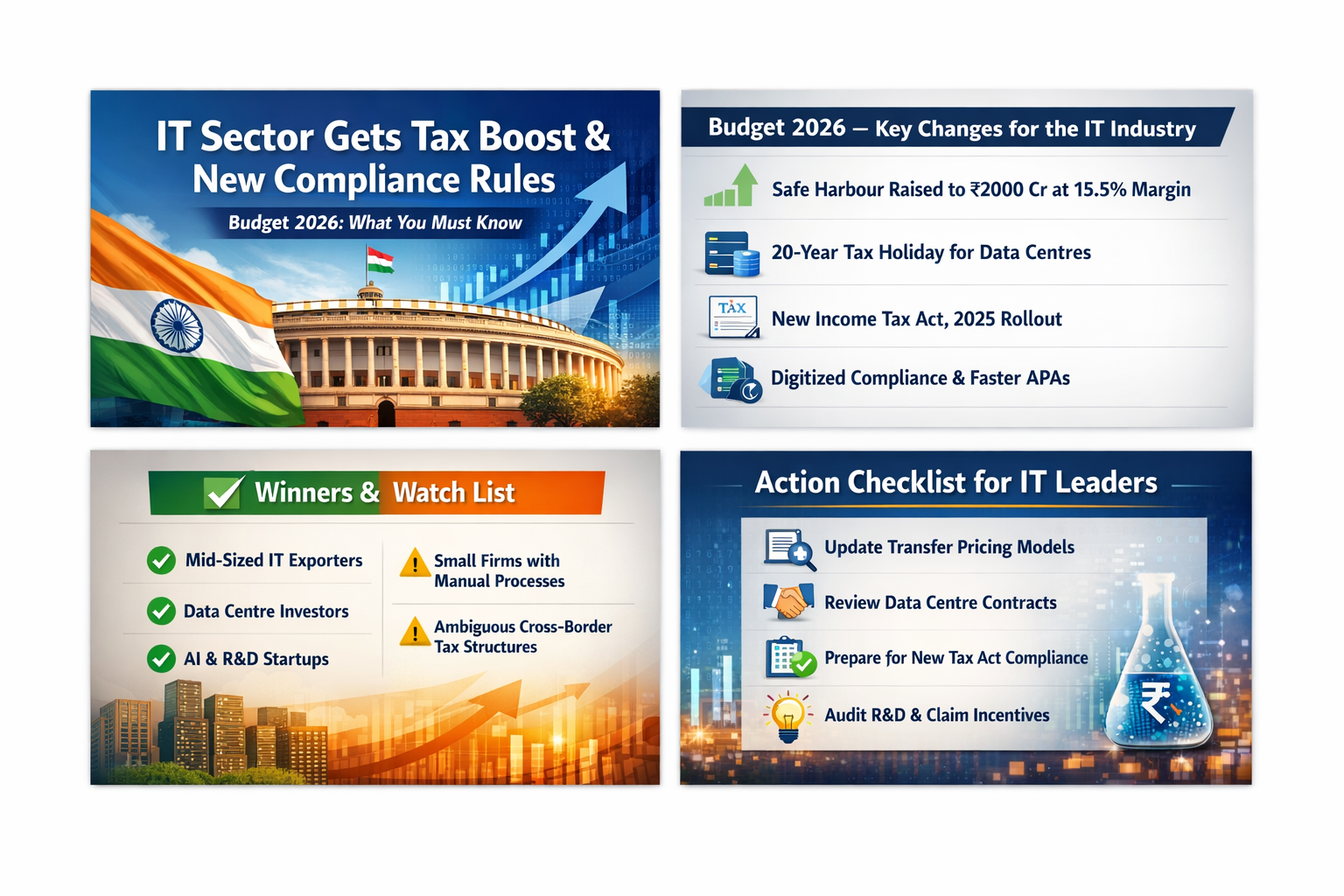

TL;DR — The exact headlines (no storytime)

- Safe harbour threshold for IT services raised from ₹300 crore to ₹2,000 crore with a uniform 15.5% margin.

- 20-year tax holiday for foreign firms using local data centres (clarifies tax treatment for cloud operations until 2047).

- Rollout of the Income Tax Act, 2025 effective April 1, 2026 — expect redesigned returns and compliance changes.

- Government pushing digitisation of compliance (system-based declarations, faster APAs, litigation reduction emphasis).

- R&D and AI push continues with targeted incentives and budget allocations; expect schemes to favour compute, data infra, and skilling.

What changed, exactly — and why it matters (practical breakdown)

1) Safe harbour expansion — who benefits, and how

Budget 2026 raises the safe harbour applicability from ₹300 crore to ₹2,000 crore, standardizing the margin to 15.5% for IT services providers. This reduces transfer-pricing disputes for many mid-sized and larger exporters of software and ITES, and lowers controversy-driven litigation and assessments. For firms operating at margins near the new threshold, this gives predictable effective tax exposure and fewer surprise adjustments.

Actionable: Recompute transfer pricing policies, update pricing models, and evaluate whether to opt-in where available. Document margin analyses to match the new 15.5% safe harbour.

2) Clarity for cloud & data centres — foreign companies get long runway

Budget 2026 offers a 20-year tax holiday to foreign firms that use Indian data centres to deliver cloud services globally (a move designed to remove uncertainty about whether hosting in India triggers taxation of global revenues). This is a major signal to hyperscalers and also helps Indian cloud infra investments attract cross-border customers.

Implication: Indian data centre operators and cloud customers can now pitch Indian hosting as tax-friendly for global cloud providers. Expect new commercial models, local contracts, and possible price renegotiations.

3) Income Tax Act, 2025 goes live — compliance is changing

The new Income Tax Act will take effect April 1, 2026. The Budget commits to simpler return forms and system-based processes, but also to stronger dispute resolution and compliance mechanisms. This is structural — it changes how tax is administered and how companies must file and respond to notices.

Actionable: Work with tax counsel to map changes to accounting close workflows, tax provisioning, and internal control documentation ahead of the new Act’s rollout.

4) Faster APAs and litigation reduction — good for large IT exporters

Budget commentary and industry responses indicate administrative steps to speed up Advance Pricing Agreements and reduce litigation. That benefits large IT multinationals and their treasury strategies. Expect more predictable outcomes for international pricing arrangements.

Actionable: If you trade cross-border or have complex intercompany models, consider applying for APAs earlier than planned.

5) R&D, AI, and skilling — real money, real focus

Budget 2026 continues to fund AI and R&D initiatives, plus skilling programs aimed at building data science and cloud engineering capacity. Policy nudges will favour firms that invest in domestic R&D, productization, and export-oriented tech.

Actionable: Revisit R&D capitalization and tax credit claims, secure grants, and align hiring/training roadmaps to attract available incentives.

What the compliance rules mean in practice (not theoretical)

- Expect stricter documentation requirements for claiming incentives and safe harbours. Don’t rely on verbal substantiation.

- Digitised system-based declarations and unified no-TDS flows will require API integrations between payroll, accounting, and tax filing tools.

- More audits may be upfront but with faster resolution cycles where systems are clean. If you have gaps in transfer pricing or intercompany documentation, they’ll show up quickly.

Who wins, who should worry

Winners:

- Mid-sized IT exporters (safer transfer pricing through safe harbour).

- Data centre investors and operators.

- Product-first AI/SaaS startups that claim R&D credits and skilling grants.

Watch closely:

- Small firms that haven’t automated accounting; digitisation will increase friction.

- Companies dependent on ambiguous cross-border tax structures without formal APAs or documentation.

CFO / CTO / Founder checklist (do this this week)

- Re-run transfer pricing model vs new safe-harbour 15.5%. If margins differ, document rationale.

- Talk to your tax advisor about whether an APA makes sense now.

- Review contracts with cloud vendors and data centre partners; identify any clauses affected by the 20-year tax clarity.

- Audit R&D spends and labelling to capture incentives and grants.

- Ensure accounting systems can export the new forms the Income Tax Act will require; automate where possible.

- Update investor decks and tax disclosures to reflect lower transfer pricing litigation risk or changes to effective tax rate.